Welcome to ZAP Accounting Software. We value your time. The sections on this home page include:

0) Advisory Committee Now forming...

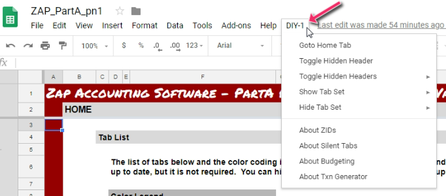

1) Introduction to ZAP Accounting Software

2) ZAP Accounting Software is and is NOT...

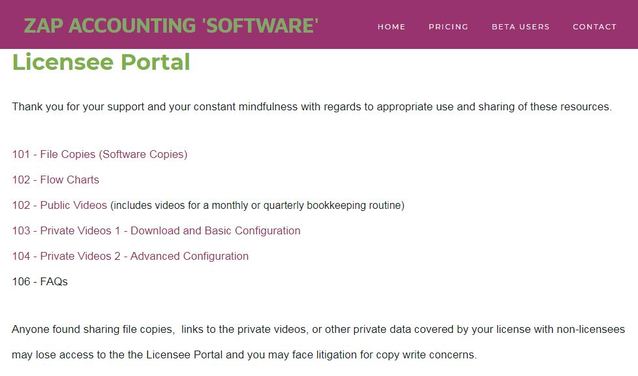

3) The ZAP Accounting Software License is...

4) The ZAP Accounting Sponsored User Permit is...

5) Comparative Benefits for ALL who use the software are..

6) Small Business Accounting Best Practices + ZAP Accounting Part A = Holistic Programming for YOU

7) Data Privacy and Security

8) The 220 Club -- A publisher with Free and Paid Offerings

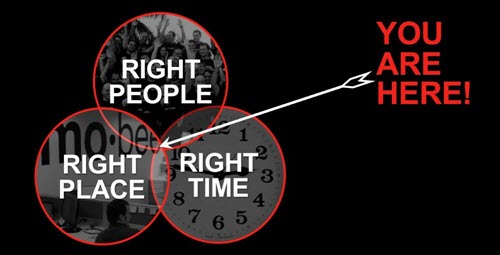

A new type of commercial train has arrived. Hop aboard and give it a try! It was designed with YOU in mind.

Interested in being on the Advisory Committee? click here...

0) Advisory Committee Now forming...

1) Introduction to ZAP Accounting Software

2) ZAP Accounting Software is and is NOT...

3) The ZAP Accounting Software License is...

4) The ZAP Accounting Sponsored User Permit is...

5) Comparative Benefits for ALL who use the software are..

6) Small Business Accounting Best Practices + ZAP Accounting Part A = Holistic Programming for YOU

7) Data Privacy and Security

8) The 220 Club -- A publisher with Free and Paid Offerings

A new type of commercial train has arrived. Hop aboard and give it a try! It was designed with YOU in mind.

Interested in being on the Advisory Committee? click here...